Navigating the world of insurance in the Philippines can be confusing and time-consuming. Finding the best deals, understanding the fine print, and competing requirements are challenging. But what if you had a personal shopper with insider knowledge and a lifelong advisor by your side? This is where insurance brokers come in, providing unparalleled support and expertise. Let’s explore why getting insurance from a broker is the smartest move you can make.

Reliable Insurance Brokers

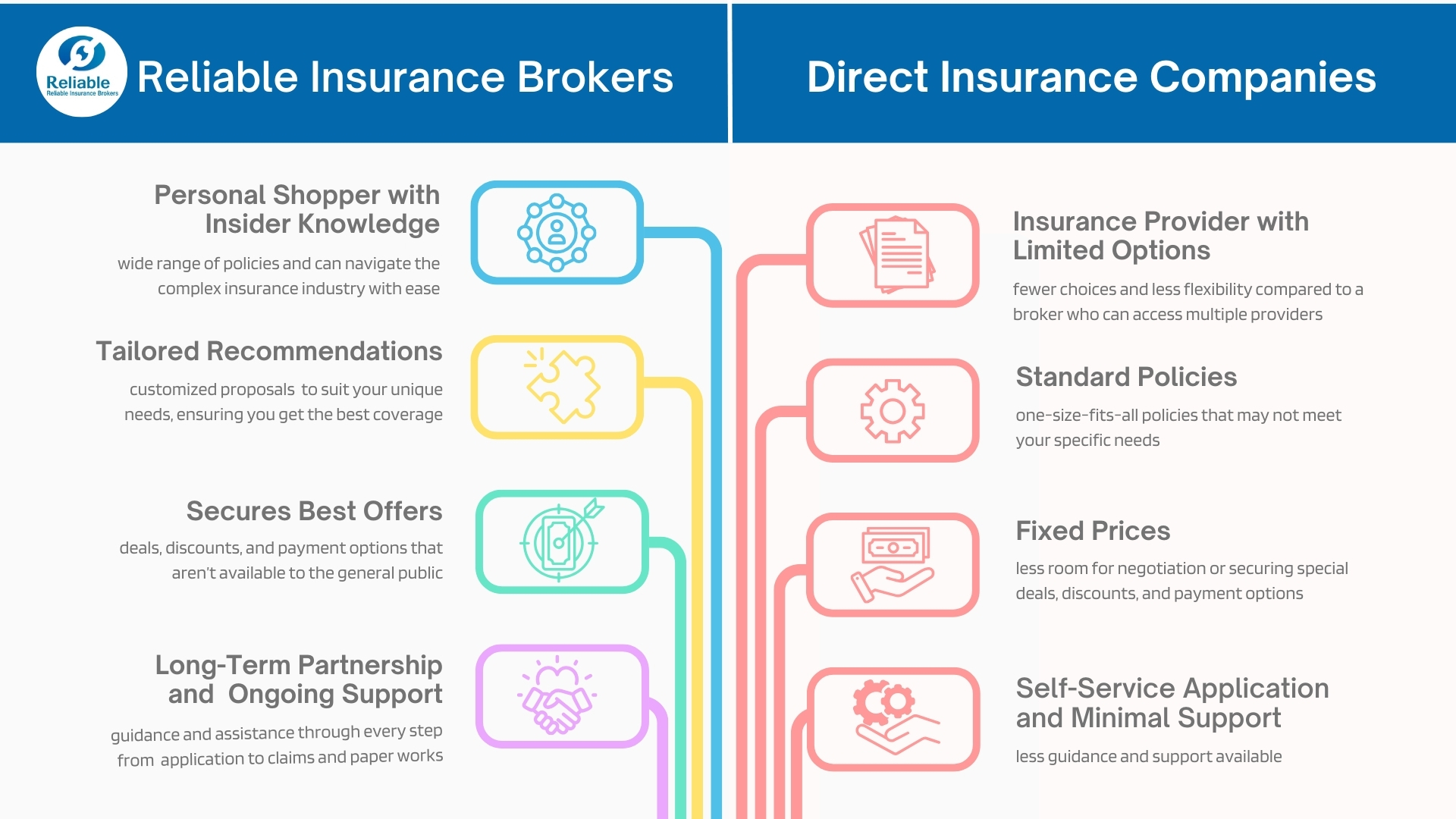

Personal Shopper with Insider Knowledge

- Wide Range of Policies: Brokers have access to numerous policies from various providers, giving you more choices. View list of accredited insurance companies.

- Industry Expertise: Brokers understand the complex landscape of insurance and can navigate it efficiently.

- Time-Saving: We handle all the research and comparison, saving you significant time and effort.

- Professional Guidance: Brokers provide expert advice, helping you make informed decisions.

- Up-to-date Information: We stay updated with the latest industry trends and policy changes, ensuring you get the most current options.

Tailored Recommendations

- Customized Proposals: Brokers tailor their recommendations to suit your unique needs and circumstances.

- Personalized Service: We take the time to understand your specific situation, offering solutions that best fit your requirements.

- Optimal Coverage: By customizing policies, brokers ensure you get the best possible coverage.

- Holistic Approach: Brokers consider all aspects of your life and business, providing comprehensive insurance solutions.

- Regular Reviews: We regularly review your policies to ensure we continue to meet your evolving needs.

Secures Best Offers

- Exclusive Deals: Brokers often have access to special deals and discounts not available to the general public.

- Negotiation Skills: We negotiate on your behalf to secure the best rates and terms.

- Cost-Effective Solutions: Brokers find the most cost-effective policies, ensuring you get great value for your money.

- Payment Flexibility: We can arrange customized payment plans to fit your financial situation.

- Added Benefits: Brokers may offer additional services or benefits as part of their package.

Long-Term Partnership and Ongoing Support

- Continuous Assistance: Brokers provide ongoing support, helping with renewals and policy updates. View our Support and Resources page.

- Claims Support: We assist with the claims process, ensuring it is handled smoothly and efficiently. Go to our Make a Claim page.

- Proactive Monitoring: Brokers monitor your coverage and alert you to any necessary changes.

- Problem Solvers: We troubleshoot any issues with your policies and resolve conflicts with insurers.

- Lifetime Advisor: Brokers remain a constant resource, offering advice and support as your insurance needs evolve.

Direct Insurance Companies

Insurance Provider with Limited Options

- Fewer Choices: Direct insurers typically offer a limited range of policies.

- Less Flexibility: You have fewer options to customize your coverage.

- No Comparisons: You need to compare policies yourself, which can be time-consuming and confusing.

Standard Policies

- One-Size-Fits-All: Direct insurers often provide generic policies that may not meet your specific needs.

- Lack of Personalization: Policies are not tailored to your unique situation.

- Inadequate Coverage: Standard policies might leave gaps in your coverage, exposing you to risks.

Fixed Prices

- No Negotiation: Direct insurers offer fixed prices with no room for negotiation.

- Higher Costs: You may end up paying more without the benefit of special deals or discounts.

- Rigid Payment Plans: Limited flexibility in payment options.

Self-Service Application and Minimal Support

- DIY Process: You handle all the paperwork and application processes yourself.

- Limited Assistance: Minimal support is available during and after the purchase process.

- Stressful Claims: Handling claims can be stressful without professional assistance.

- Lack of Guidance: Without expert advice, you may miss critical details or make uninformed decisions.

Insurance is not just a purchase; it’s a partnership. With a broker, you gain a personal shopper who finds the best deals and a lifelong advisor who stands by you through every milestone. They bring expertise, dedication, and personalized service, making your insurance journey smooth and worry-free. Trust in Reliable Insurance Brokers to be your shield and support, securing what matters most to you.

Ready to experience the benefits of having a personal insurance shopper and lifelong advisor? Contact Reliable Insurance Brokers today and discover the difference.

Contact Information for Inquiries and Support

Should you have any questions or require further assistance:

- Call: +63 2 8631 9285 to 86

- Mobile: +63 917 138 5120

- Email: info@reliable-insurance.ph

- Messenger: https://m.me/reliable.insurancebrokersph